Real Estate California

NNN Commercial Leases vs Gross Leases

Understanding NNN Commercial Leases and Gross Leases: A Comparison

When venturing into the world of commercial real estate, understanding the different types of leases available is crucial for making informed decisions. Two common types of commercial leases are NNN (Triple Net) leases and Gross leases. Each has its unique structure, benefits, and drawbacks, which can significantly impact both landlords and tenants. This blog will provide a detailed comparison of NNN leases and Gross leases, helping you navigate your options more effectively.

What is a NNN Lease?

A Triple Net (NNN) lease is a type of commercial lease agreement where the tenant is responsible for paying the three "nets" – property taxes, property insurance, and maintenance costs – in addition to the base rent and utilities. This lease structure transfers most of the property-related expenses to the tenant, making it a popular choice for landlords who want to minimize their involvement in property management.

Advantages of NNN Leases:

- Lower Base Rent: Since tenants cover additional expenses, the base rent for NNN leases is typically lower compared to gross leases.

- Predictable Income for Landlords: Landlords benefit from a stable and predictable income stream without worrying about fluctuating property expenses.

- Incentive for Tenants to Maintain Property: Tenants have a vested interest in maintaining the property since they bear the costs of repairs and maintenance.

Disadvantages of NNN Leases:

- Variable Costs for Tenants: Tenants face variable and sometimes unpredictable costs, which can complicate budgeting.

- Management Complexity: Tenants must manage and pay multiple expenses, adding complexity to their financial planning.

- Higher Initial Costs: Initial outlays for property taxes, insurance, and maintenance can be significant for tenants.

What is a Gross Lease?

A Gross lease, also known as a full-service lease, is a type of commercial lease where the landlord covers most, if not all, property-related expenses, including property taxes, insurance, and maintenance. The tenant pays a single, all-inclusive rent amount, making it simpler for tenants to manage their finances.

Advantages of Gross Leases:

- Simplified Budgeting for Tenants: With all expenses included in the rent, tenants can easily predict their monthly costs.

- Lower Management Burden for Tenants: Tenants do not need to worry about managing and paying for additional expenses.

- Potential for Cost Savings: If the property-related expenses are lower than anticipated, tenants might pay less overall compared to a NNN lease.

Disadvantages of Gross Leases:

- Higher Base Rent: To cover the additional expenses, landlords typically charge a higher base rent in gross leases.

- Less Incentive for Tenants to Conserve: Since tenants are not directly paying for property expenses, they may be less motivated to conserve resources and maintain the property.

- Risk for Landlords: Landlords assume the risk of fluctuating property expenses, which can impact their profitability.

Key Considerations for Choosing Between NNN and Gross Leases

- Financial Predictability: Tenants who prefer stable, predictable monthly expenses may favor gross leases, while those willing to manage variable costs for potentially lower base rent may opt for NNN leases.

- Property Management: Landlords looking to minimize their management responsibilities may prefer NNN leases, while those willing to manage property expenses may find gross leases more suitable.

- Lease Negotiation: Both types of leases are negotiable, and the final terms can significantly impact the overall costs and responsibilities. Tenants and landlords should carefully negotiate the terms to align with their financial and operational needs.

Conclusion

Choosing between a NNN lease and a Gross lease depends on various factors, including financial predictability, management preferences, and overall business strategy. Both lease types offer distinct advantages and disadvantages, and understanding these can help tenants and landlords make informed decisions that best suit their needs. Whether you're looking for simplicity and stability with a gross lease or lower base rent with a NNN lease, careful consideration and negotiation are key to finding the right commercial lease agreement.

PAYAM SHIRAZI, Broker

DRE: 01925601

Call: (949) 436-3936

LOS ANGELES / ORANGE COUNTY

Home prices on the rise

In February, U.S. home prices experienced a significant surge, marking the most substantial increase in nearly two years, as reported by federal housing authorities on Tuesday. This spike underscores the persistent impact of limited housing supply on the nation's real estate market.

According to the Federal Housing Finance Agency's monthly report on home prices, prices rose by 1.2% from January, marking the largest month-to-month growth since April 2022. On a year-over-year basis, prices soared by 7%, representing the sharpest increase since November 2022.

Anju Vajja, deputy director for FHFA's division of research and statistics, highlighted the rebound in U.S. house prices in February, following a slight decline in January. Vajja noted that all nine census divisions experienced price appreciation over the past 12 months, with New England and the Middle Atlantic divisions showing double-digit growth.

Although the supply of homes on the market has seen gradual improvement in recent months, it remains significantly below historical norms. This shortage persists because many homeowners secured mortgages with low interest rates before the Federal Reserve initiated its rate-hike cycle over two years ago. The prospect of financing new homes at rates exceeding 7% for a 30-year fixed-rate mortgage deters many homeowners from relocating or upsizing, contributing to the limited supply.

Furthermore, the sluggish pace of home construction exacerbates the housing shortage, preventing new properties from entering the market. These factors collectively contribute to a national housing shortage and affordability challenge.

The surge in home prices in February may not be well-received by the Federal Reserve, which has encountered hurdles in its efforts to curb inflation in 2024. While home prices do not directly influence the inflation measures tracked by the U.S. central bank, they indirectly contribute to metrics such as imputed rents included in inflation indexes, which have remained persistently high.

PAYAM SHIRAZI, Broker

DRE: 01925601

Call: (949) 436-3936

LOS ANGELES / ORANGE COUNTY

Cap Rate

Cap Rate Explained

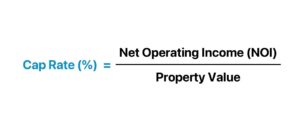

The capitalization rate, often referred to as the cap rate, is a fundamental metric used in real estate investing to evaluate the potential return on investment for a property. It's essentially the ratio between the net operating income (NOI) generated by a property and its current market value or purchase price. Here's how it's calculated:

The net operating income (NOI) is the income generated by the property after deducting all operating expenses, such as property taxes, insurance, maintenance costs, and property management fees, but before deducting mortgage payments and income taxes.

A higher cap rate indicates a higher potential return on investment, while a lower cap rate suggests a lower potential return. However, it's important to note that cap rates can vary significantly depending on factors such as location, property type, market conditions, and risk factors associated with the investment. Typically, properties with higher risk or lower growth potential tend to have higher cap rates, while properties in stable or high-growth areas may have lower cap rates. Investors often use cap rates as a tool to compare different investment opportunities and assess their relative profitability.

NOI = gross operating income – operating expenses. Three ways to maximize your NOI include minimizing operating expenses, increasing rental income, and charging fees for amenities and services.

NOI is a before-tax figure, appearing on a property's income and cash flow statement, that excludes principal and interest payments on loans, capital expenditures, depreciation, and amortization.

Mansion Tax

Real Property Transfer Tax and ULA (United to House LA)

Effective for transactions closing after June 30, 2024, the new thresholds for ULA will be $5,150,000 and $10,300,000. Transactions above $5,150,000 but under $10,300,000 will be assessed a 4% tax and transactions $10,300,000 and up will be assessed a 5.5% tax.

Does the City impose a real property transfer tax other than the special tax imposed under Measure ULA?

Indeed, the City enforces a real property transfer tax on all documents that transfer real property within its jurisdiction. The current tax, known as the "Base Tax," is calculated based on the consideration or value of the real property interest being transferred, at a rate of 0.45%. Additionally, Measure ULA introduces a special tax, termed the "ULA Tax," which is levied on top of the Base Tax.

What are the rate components of the Base Tax and the ULA Tax under the City’s real property transfer tax?

- The Base Tax rate of $2.25 per $500 or part thereof (“Base Rate”).

- The ULA Tax rates of, 1) 4% for properties conveyed over $5,000,000, but under $10,000,000, and 2) 5.5% for properties conveyed at $10,000,000 or more (“ULA Rates”).

Value of Property Conveyed

| Value of Property Conveyed | Base Rate* | ULA Rate | Applicable Tax Rate |

| > $100; ≤ $5,000,000 | $2.25 / $500 | 0% | 0.45%* |

| > $5,000,000; < $10,000,000 | $2.25 / $500 | 4% | 4.45%* |

| ≥ $10,000,000 | $2.25 / $500 | 5.5% | 5.95%* |

*Note: the City’s Base Rate is $2.25 for every $500 or fractional part thereof. A transfer in which the value of the property conveyed is not divisible by $500 will be rounded up to the nearest $500 for the calculation of the Base Tax. This does not apply to the ULA Rate calculations, which are percentage-based.

DISCLAIMER: This is not tax advice. Please refer to the link below for further information.

1% Commission Listing Service

1% COMMISSION LISTING

2024 SUMMER SPECIAL: Our mission is clear – to redefine the real estate experience by offering unparalleled service at a remarkable commission rate. In a world where every percentage point matters, we are here to transform the way you buy or sell your property. Unlike traditional real estate services that charge hefty commissions, we have redefined the game with a flat 1% commission rate listing. Yes, you read it right!

We will save you thousands without compromising on quality service.

CALL NOW TO SEE IF YOUR PROPERTY QUALIFIES.

(949) 436-3936

PAYAM SHIRAZI, Broker

DRE: 01925601

Call: (949) 436-3936

LOS ANGELES / ORANGE COUNTY

Q1 2024 Los Angeles, Orange County, San Francisco average sale price per SqFt

Average price per SqFt comparason.

LA vs OC vs FS

PAYAM SHIRAZI, Broker

DRE: 01925601

Call: (949) 436-3936

LOS ANGELES / ORANGE COUNTY

What are Proposition 60 and 90?

Proposition 60 and Proposition 90 are both California property tax relief measures that provide certain homeowners with the opportunity to transfer their property tax base to a replacement residence under specific conditions. Here's an explanation of each:

- Proposition 60:

- Proposition 60 allows homeowners who are 55 years of age or older to transfer the assessed value of their current primary residence to a replacement property within the same county, as long as certain conditions are met. This transfer helps homeowners avoid a potentially higher property tax assessment that would result from purchasing a new home with a higher market value.

- To qualify for Proposition 60, the replacement property must be of equal or lesser value compared to the original property, and the replacement must occur within two years of the sale of the original property.

- This proposition is especially beneficial for retirees or older homeowners who may want to downsize or move to a more suitable residence without facing a significant increase in property taxes.

- Proposition 90:

- Proposition 90 extends the benefits of Proposition 60 to homeowners who are moving to a different county within California. It allows eligible homeowners to transfer their property tax base to a replacement property in a different county, provided that the county where the replacement property is located has adopted an ordinance authorizing such transfers.

- Not all counties in California participate in Proposition 90, so homeowners should check with the county assessor's office in both the county they are leaving and the county they are moving to in order to determine eligibility and any specific requirements.

- Like Proposition 60, Proposition 90 also requires that the replacement property be of equal or lesser value compared to the original property and that the replacement occurs within two years of the sale of the original property.

Both Proposition 60 and Proposition 90 aim to provide property tax relief for eligible homeowners in California who are looking to move or downsize without facing a significant increase in property taxes. However, it's essential for homeowners to understand the specific criteria and limitations of each proposition and to consult with local authorities or legal professionals for guidance regarding their individual situations.

As of January 2022, the following counties in California have adopted ordinances to accept inter-county transfers under Proposition 60 and/or Proposition 90:

- Alameda County

- El Dorado County

- Los Angeles County

- Orange County

- Riverside County

- San Bernardino County

- San Diego County

- San Mateo County

- Santa Clara County

- Tuolumne County

- Ventura County

Please note that this list may not be exhaustive, and it's always a good idea to verify with the respective county assessor's office or consult official resources for the most up-to-date information regarding Proposition 60 and 90 inter-county transfers in California. Additionally, the specifics of these ordinances, such as eligibility criteria and limitations, may vary between counties.

PAYAM SHIRAZI, Broker

DRE: 01925601

Call: (949) 436-3936

LOS ANGELES / ORANGE COUNTY

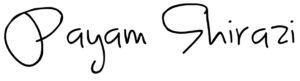

Current Inventory Update – August 2023

40% reduction in residential listing inventory when comparing August 2023 to the same period in 2022

Gain a competitive edge in your real estate quest with our comprehensive, custom-tailored local market reports. Whether you have your eye on particular neighborhoods, cities, or ZIP codes, we've got you covered. Just get in touch with us through phone, text, or email, and we'll furnish you with the market intelligence and data necessary for well-informed choices. Don't wait – request your personalized report today!

Call: (949) 436-3936

Email: [email protected]

PAYAM SHIRAZI, Broker

DRE: 01925601

Call: (949) 436-3936

LOS ANGELES / ORANGE COUNTY

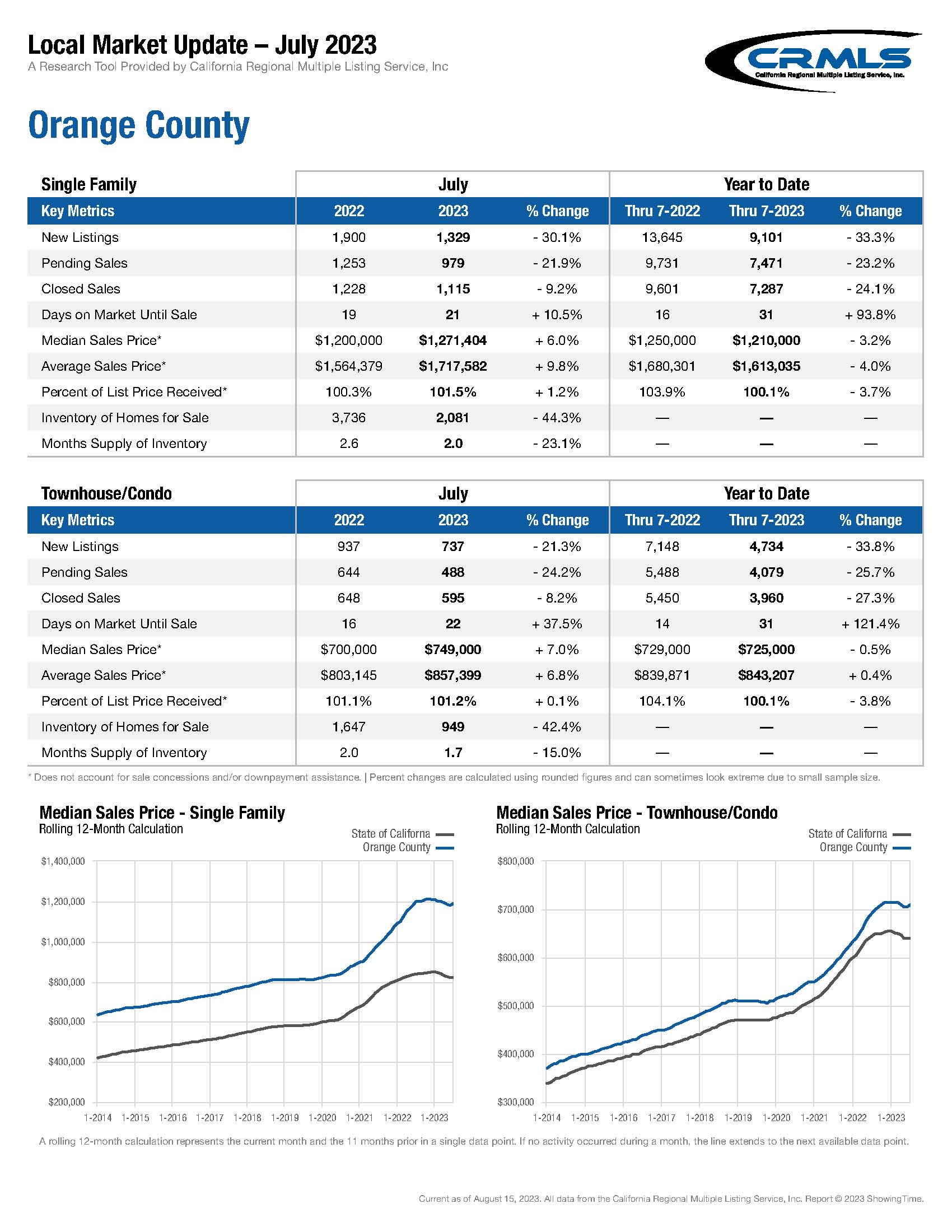

Orange County Market Update – July 2023

Median single-family home price up 6% from July 2022

Median Townhome/Condo price up 7% from July 2022

Discover tailored market reports for your desired neighborhoods, cities, or ZIP codes—just ask! Feel free to reach out to me via phone, text, or email to request your personalized insights.

Call: (949) 436-3936

Email: [email protected]

Source: CRMLS, California Regional Multiple Listing Service, Inc.

PAYAM SHIRAZI, Broker

Call: (949) 436-3936

ORANGE COUNTY / LOS ANGELES

Liens vs. Encumbrances: How They Impact Property Sales!

Liens vs. Encumbrances: How They Impact Property Sales!

Liens are like financial encumbrances, representing debts recorded against your property. Examples include voluntary liens like mortgage liens and contractor-recorded mechanic's liens. On the other hand, encumbrances refer to any claim against a property in a broader sense.

When liens or encumbrances are filed against your property, it means that whoever buys your home will inherit these burdens. As a result, the likelihood of someone purchasing your property with existing liens or encumbrances is very low.

To facilitate the sale or refinancing of your property, it's crucial to pay off these liens or encumbrances beforehand. This step is typically required before most potential buyers or lenders consider moving forward.

Stay informed about the impact of liens and encumbrances on your property's sale and take proactive steps to resolve any outstanding debts. Your real estate agent can guide you through the process and help ensure a smooth transaction.

Contact me to know how this can affect the sale of your property!

PAYAM SHIRAZI, Broker

Direct: (949) 436-3936

Email: [email protected]