Posts Tagged ‘Investment’

Cap Rate

Cap Rate Explained

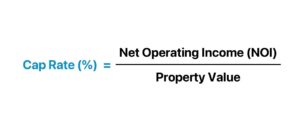

The capitalization rate, often referred to as the cap rate, is a fundamental metric used in real estate investing to evaluate the potential return on investment for a property. It's essentially the ratio between the net operating income (NOI) generated by a property and its current market value or purchase price. Here's how it's calculated:

The net operating income (NOI) is the income generated by the property after deducting all operating expenses, such as property taxes, insurance, maintenance costs, and property management fees, but before deducting mortgage payments and income taxes.

A higher cap rate indicates a higher potential return on investment, while a lower cap rate suggests a lower potential return. However, it's important to note that cap rates can vary significantly depending on factors such as location, property type, market conditions, and risk factors associated with the investment. Typically, properties with higher risk or lower growth potential tend to have higher cap rates, while properties in stable or high-growth areas may have lower cap rates. Investors often use cap rates as a tool to compare different investment opportunities and assess their relative profitability.

NOI = gross operating income – operating expenses. Three ways to maximize your NOI include minimizing operating expenses, increasing rental income, and charging fees for amenities and services.

NOI is a before-tax figure, appearing on a property's income and cash flow statement, that excludes principal and interest payments on loans, capital expenditures, depreciation, and amortization.

Earning a living and building wealth are miles appart.

All Dollars Are Not Created Equal!

Dollars from rental property are better than other incomes.

Do you like to know why?

Job dollars and real estate income dollars both look the same but Job dollars are the worst.

| Job Dollars or Hardest to Earn Dollar |

| 👇 |

|

Worst dollar is subject to:

|

| Real Estate Dollars or Making Wealth Dollar |

| 👇 |

|

|

Making wealth dollar is:

|

THIS IS A GRAND TIME TO BE A REAL ESTATE INVESTOR

Call today to find out more.

Payam Shirazi

(949) 436-3936

E-Mail: [email protected]

Broker DRE: 01925601