Real Estate California

West Los Angeles/LA County – Price per square foot comparison.

West Los Angeles vs LA County

Average Price/sqft - Average Days on Market

Brought to you by:

Payam Shirazi | Broker Associate | Realty ONE Group West

(949) 436-3936 | [email protected] | www.payamhomes.com

Mission Viejo vs Irvine vs Laguna Niguel vs Santa Ana

Mission Viejo vs Irvine vs Laguna Niguel vs Santa Ana

Irvine vs Mission Viejo vs Laguna Niguel vs Newport Beach | Average Days on Market

Average Days on Market

Irvine, Mission Viejo, Laguna Niguel, Newport Beach

Irvine, Mission Viejo, Laguna Niguel, Santa Ana

Irvine – Mission Viejo – Laguna Niguel – Newport Beach – Santa Ana | Average Sale Price

Deciding to Downsize

People of all generations are downsizing their homes.

Find out why baby boomers, specifically, are choosing to do so.

Call today to find out more.

Payam Shirazi

(949) 436-3936

E-Mail: [email protected]

Broker DRE: 01925601

Primary Reasons for downsizing.

Earning a living and building wealth are miles appart.

All Dollars Are Not Created Equal!

Dollars from rental property are better than other incomes.

Do you like to know why?

Job dollars and real estate income dollars both look the same but Job dollars are the worst.

| Job Dollars or Hardest to Earn Dollar |

| 👇 |

|

Worst dollar is subject to:

|

| Real Estate Dollars or Making Wealth Dollar |

| 👇 |

|

|

Making wealth dollar is:

|

THIS IS A GRAND TIME TO BE A REAL ESTATE INVESTOR

Call today to find out more.

Payam Shirazi

(949) 436-3936

E-Mail: [email protected]

Broker DRE: 01925601

NAR Real Estate Forecast Summit

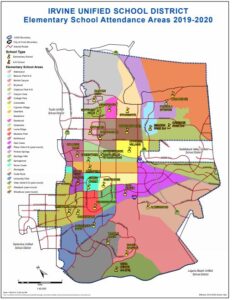

IRVINE SCHOOL DISTRICT BOUNDARIES MAP

To view a printable map of the elementary school attendance areas effective 2019-2020, please click here.

To view a printable map of the middle school attendance areas effective 2019-2020, please click here.

To view a printable map of the high school attendance areas effective 2019-2020, please click here.

Tenant Protection Act of 2019-Part 2 of 2

Tenant Protection Act of 2019-Part 2 of 2

(Just Cause Eviction Law)

What is the Tenant Protection Act (TPA)? Effective 1-1-20, the TPA prohibits, with exemptions, an owner from

evicting a residential tenant except for 15 specified reasons. There are two types of reasons: “At fault” and “No fault”.

Exemptions from Just Cause rules:

● Housing that has been issued a certificate of occupancy within the previous 15 years (new housing);

● A duplex in which the owner occupies one of the units at the commencement of and throughout the tenancy;

● A single-family residential property (including condominiums) so long as:

- The owner is not a corporation, not an LLC with at least one owner who is a corporation, and not a real

estate investment trust (REIT) AND - The owner gives the tenant a legally required notice of this exemption. Ownership by individuals,

partnerships, individual co-owners, trusts, and LLCs with no corporate owners, all qualify for the exemption.

● A single-family residence in which the owner lives and if the owner rents or leases no more than two bedrooms or

units (including an accessory dwelling unit such as a “granny-flat”);

● An owner-occupied property in which the owner and tenant share a bathroom or kitchen. The law recognizes that an

owner who lives with tenants should not be “stuck” with an incompatible tenant.

● A tenant who has not continuously and lawfully occupied the property for 12 months.

Giving notice of the Just Cause exemptions:

C.A.R. form “Rent Cap and Just Cause Addendum” (RCJC) (available December 2019) may be used as follows:

For month to month tenants: For new tenancies starting on or after January 1, 2020, incorporate the RCJC

into the rental agreement. For existing tenancies, incorporate the RCJC by using a change in terms of tenancy,

such as C.A.R. “Notice of Change in Terms of Tenancy” (Form CTT).

For Fixed Term Leases: For new tenancies starting on or after January 1, 2020, incorporate the RCJC into the

new lease. For existing tenancies, simply provide the form as a stand-alone notice. If not already provided,

incorporate the RCJC into the lease upon any renewal or extension of existing leases.

What are reasons an owner may evict a tenant for at-fault just cause?

(1) A default in the payment of rent; (2) A breach of a material term of the lease; (3) The tenant commits a nuisance or

uses the property for criminal or unlawful purposes; (4) The tenant assigns or sublets the property in violation of the

lease/rental; (5) The tenant refuses to allow the owner access; (6) The tenant refuses to sign an extension/renewal at

the expiration of the lease/rental.

What are reasons an owner may evict a tenant for no-fault just cause?

(1) The owner is withdrawing the property from the rental market; (2) The owner intends to demolish or substantially

remodel the property. Cosmetic improvements alone do not qualify; (3) The owner, or the owner’s family members

intends to occupy the unit PROVIDED the tenant has previously agreed to allow such a termination or if a provision of

the lease permits it. C.A.R. form RCJC may be used for this purpose. NOTE: For all no-fault evictions, the owner must

pay the tenant a one-month relocation fee or waive rent for the final month of the tenancy.

Does the TPA preempt local just cause eviction ordinances? If a city or county adopted a just cause eviction

ordinance on or before September 1, 2019, that ordinance applies and not the TPA. If a local just cause eviction

ordinance was adopted or amended after September 1, 2019 it only applies if it is more protective of tenants than

the TPA.

NOTE: Quick Guide Tenant Protection Act of 2019-Part 1 (Statewide Rent Cap Law) provides information on the

Rent Cap portion of the TPA.

Source: California Association of REALTORS®. October 22, 2019. Link

Tenant Protection Act of 2019-Part 1 of 2

Tenant Protection Act of 2019-Part 1 of 2

(Statewide Rent Cap Law)

What is the Tenant Protection Act (TPA)? Effective 1-1-20, the TPA establishes, throughout all of California, a

maximum amount an owner may increase a residential tenant’s rent in a 12-month period. The cap is 5% plus

inflation, not to exceed 10%. There are exemptions.

Exemptions from the Rent Cap rules

● Housing that has been issued a certificate of occupancy within the previous 15 years (new housing);

● A duplex in which the owner occupies one of the units at the commencement of and throughout the tenancy;

● A single-family residential property (including condominiums) so long as:

- The owner is not a corporation, not an LLC with at least one owner who is a corporation, and not a real

estate investment trust (REIT) AND - The owner gives the tenant a legally required notice of this exemption. Ownership by individuals,

partnerships, individual co-owners, trusts, and LLCs with no corporate owners, all qualify for the exemption.

Giving notice of the Rent Cap exemptions:

C.A.R. form “Rent Cap and Just Cause Addendum” (RCJC) (available December 2019) may be used as follows:

For month to month tenants: For new tenancies starting on or after January 1, 2020, incorporate the RCJC

into the rental agreement. For existing tenancies, incorporate the RCJC by using a change in terms of

tenancy, such as C.A.R. “Notice of Change in Terms of Tenancy” (Form CTT).

For Fixed Term Leases: For new tenancies starting on or after January 1, 2020, incorporate the RCJC into

the new lease. For existing tenancies, simply provide the form as a stand-alone notice. If not already

provided, incorporate the RCJC into the lease upon any renewal or extension of existing leases.

Can rent be raised more than the maximum before the effective date?

Yes, however, the maximum Rent Cap raise is linked to the rent charged as of March 15, 2019. If rent was increased

more than the allowable amount (5% + inflation) before 1/1/2020 it must be rolled back to the allowable amount as

of 1/1/2020. Amounts collected before then do not have to be refunded to the tenant.

Does the TPA preempt local rent control ordinances?

Local Government Rent Caps: If a city or county limits rent increases to an amount less than that authorized by the

TPA, then the local ordinance applies. If a government entity is not as restrictive as the TPA, then the TPA applies.

Does the TPA limit the rent that an owner may charge a new tenant?

No. The initial rental rate charged a new tenant is not subject to the Rent Cap in the TPA. Subsequent increases to

the new tenant will be subject to the TPA.

Is it necessary for an owner to hire a lawyer before attempting to raise rent or evict a tenant?

The application of the TPA and its many exemptions and requirements, as well as the interplay between the TPA

and local ordinances can be complicated, and failure to abide by the law can have severe consequences. For that

reason, it is recommended that a property owner consult with a qualified real estate attorney familiar not just with

the TPA but also with local law.

NOTE: Quick Guide Tenant Protection Act of 2019-Part 2 (Just Cause Eviction Law) provides information on

the Just Cause Eviction portion of the TPA.

Source: California Association of REALTORS®. October 22, 2019. Link